Fbar Filing Due Date 2025

Fbar Filing Due Date 2025. In a news release, the irs reminded individuals and entities who missed the april 15. [download our complete 2025 tax calendar to keep your tax filing on track.] october.

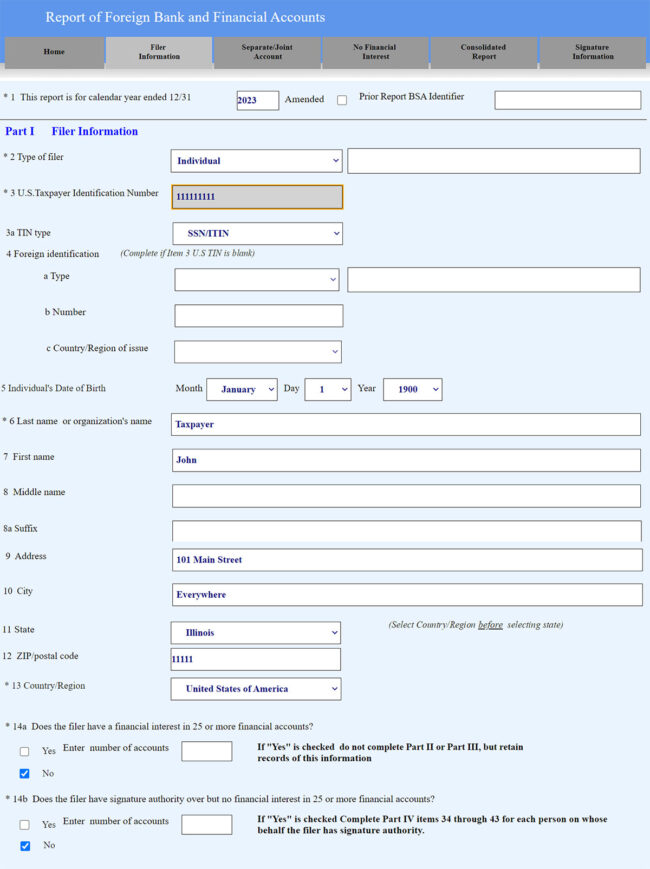

April 15, 2025, with an automatic extension to october 15, 2025, aligning with the tax return extension. Based on the current law, for the vast majority of filers, the 2025 fbar deadline will be april 15, 2025.

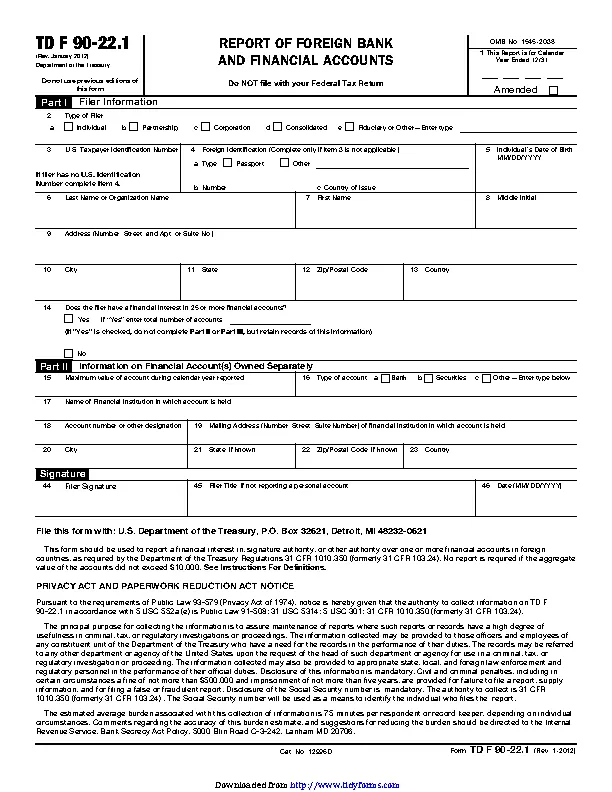

2025 Fbar Form Printable Forms Free Online, Based on the current law, for the vast majority of filers, the 2025 fbar deadline will be april 15, 2025. [download our complete 2025 tax calendar to keep your tax filing on track.] october.

FBAR Filing Instructions & Requirements For 2019 Sovereign Research, At the current time, the filing due date is presumably still the same, which is april 15th. Tired of paying someone else to file the fbar for you?

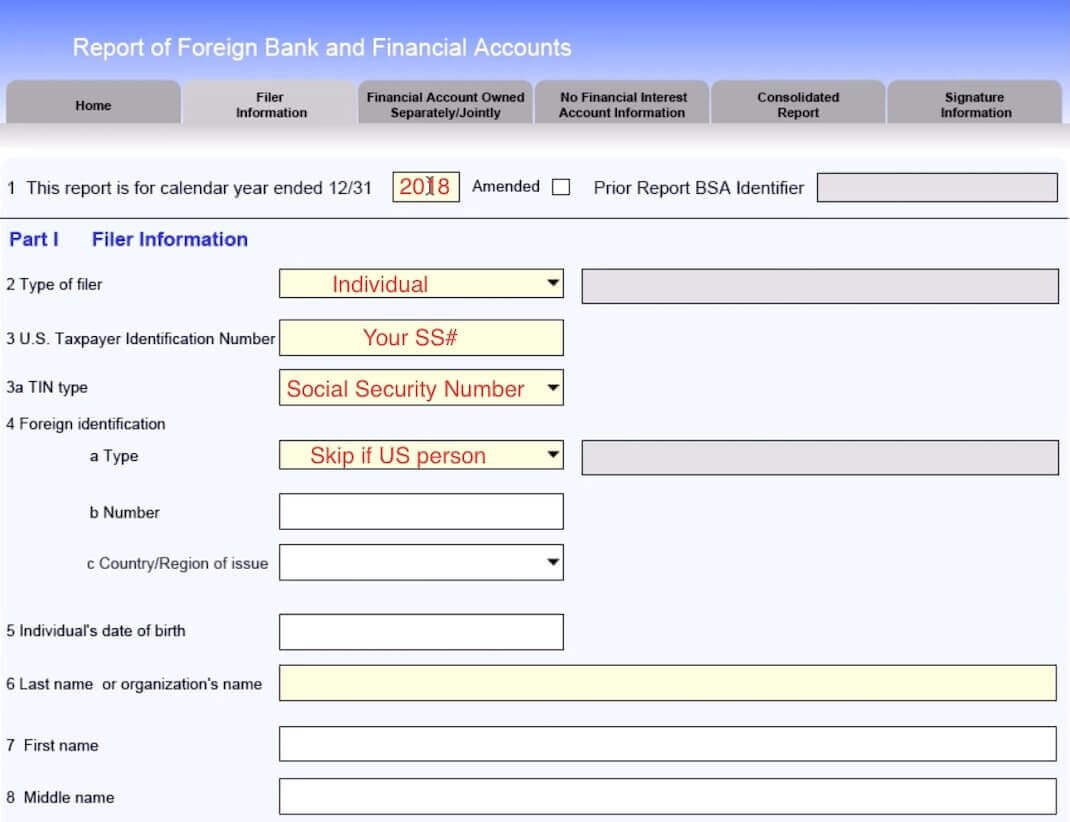

FBAR Form Filing & Due Dates The Ultimate Guide, Based on the current law, for the vast majority of filers, the 2025 fbar deadline will be april 15, 2025. Fbar deadline (fincen form 114) april.

Due Date for Filing FBAR Castro & Co. [2025], That means the fbar deadline has been. Fincen noted that because the proposal has not been finalized, it is further extending the filing due date to april 15, 2025, for individuals who previously qualified.

Everything You Need to Know About the FBAR Greenback Expat Tax Services, April 15, 2025, with an automatic extension to october 15, 2025, aligning with the tax return extension. Joint vs single filing considerations there.

![Due Date for Filing FBAR Castro & Co. [2025]](https://www.castroandco.com/images/blog/due-date-for-filing-fbar.2308141301567.jpg)

FBAR Filing Requirements 2025 Guide Gordon Law, Your 2025 foreign bank accounts report (fbar) is due april 15th with an automatic extension to october 15th. Thomson reuters tax & accounting.

What is FBAR and FBAR Filing? (2025) Manay CPA, The fbar 2025 deadline is the same as your income tax return due date, usually. But, for the past several years the filing of the fbar has been on automatic extension.

Do You Qualify for the New FBAR Filing Extension US Tax Law, October 7, 2025 · 5 minute read. Deadline to pay tax due:

FBAR Filing Requirements and Streamlined Disclosure Options YouTube, Typically, the statute of limitations for fbar penalties is six (6) years, with the maximum fbar penalty per year being $10,000 — although the $10,000 adjusts for inflation. The foreign bank account report (fbar) form falls in line with the typical us tax deadline:

FBAR Filing Requirements A Simple Guide Gordon Law Group, The foreign bank account report (fbar) form falls in line with the typical us tax deadline: [download our complete 2025 tax calendar to keep your tax filing on track.] october.

The fbar is an annual filing and if you want to avoid penalties, make sure to file fincen form 114 by the due date.